What Is Off Balance Sheet Activity

Off-balance sheet activities normally generate fees but produce liabilities or assets that are deferred or contingent and thus under GAAP do not appear on the institutions balance sheet until or unless they become actual assets or liabilities. Now off-balance sheet activities can affect the future shape of the financial institutions balance sheet thus can be a significant source of risk exposure.

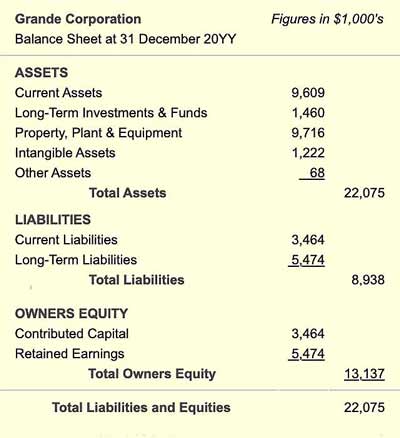

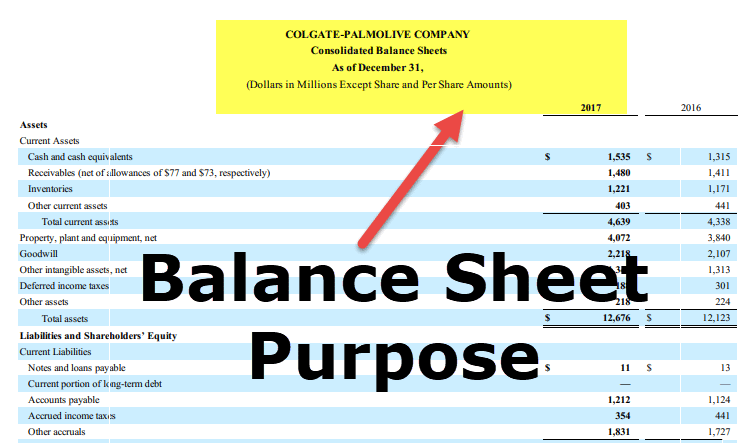

Financial Statements 101 How To Read And Use Your Balance Sheet

The use of off-balance sheet may improve activities earnings ratios because earnings generated from the.

What is off balance sheet activity. Off-Balance sheet financing is a method to not record the loan on the liabilities side. The business activities of a savings association that generally do not involve booking assets loans and taking deposits. Off-balance-sheet activities or items are contingent claim contracts.

Off-Balance Sheet OBS Also known as Off-Balance sheet items Off-Balance sheet assets or liabilities and Incognito Leverage. Off balance sheet refers to those assets and liabilities not appearing on an entitys balance sheet but which nonetheless effectively belong to the enterprise. These items are usually associated with the sharing of risk or they are financing transactions.

Off balance sheet refers to the assets debts or financing activities that are not presented on the balance sheet of an entity. Off balance sheet items in other words are. Off-balance sheet activities include items such as loan commitments letters of credit and revolving underwriting facilities.

Such financing is usually used when the borrowing of additional debt may break a debt covenant. Similarly an item is an off-balance-sheet liability when the contingent event creates an on-balance-sheet liability. Off balance sheet activity means an asset or debt or financing activity that is not on the companys balance sheet.

Off-balance sheet financing is the companys practice of excluding certain liabilities and in some cases assets from getting reported in the balance sheet in order to keep the ratios such as debt-equity ratios low to ease financing at a lower rate of interest and also to avoid the violation of covenants between the lender and the borrower. Institutionsare required to report off-balance sheet items in conformance with Call Report Instructions. Keeping debt off the balance sheet allows a company to appear more creditworthy but misrepresents the firms financial structure to creditors shareholders and the public.

An off-balance sheet activity does not appear on the financial intuitions balance sheet rather it is shown as a note bellow the balance sheet. They are either a liability or an asset which are not shown on a companys balance sheet as the business is not a legal owner of the respective item. Off-balance-sheet financing An accounting technique in which a debt for which a company is obligated does not appear on the companys balance sheet as a liability.

Off-Balance sheet financing lowers the debt equity ratio presenting a lucrative financial statement to the investors. Off-balance sheet activities Definition. Definition of off balance sheet transactions Off balance sheet events are comprised of financial transactions that are not captured or disclosed anywhere on a companys balance sheet.

An item is classified as an off-balance-sheet asset when the occurrence of the contingent event results in the creation of an on-balance-sheet asset. Off-balance sheet OBS items are an accounting practice whereby a company does not include a liability on its balance sheet. Off balance sheet financing allows an entity to borrow being without affecting calculations of measures of indebtedness such as debt to equity DE and leverage ratios low.

While not recorded on the balance sheet itself these items are. This may seem illegal but is actually a legitimate process very much allowed by the Generally Accepted Accounting Principles GAAP. Off-balance sheet items are those assets that are not directly owned by the business and therefore do not appear in the basic format of the balance sheet although they tend to impact indirectly to the financials of the company.

Managing Your Money Financial Statements Made Simple Assets Vs Liabilities Personal Financial Statement Financial Statement Income Statement

Daphyzak Inc On And Off Balance Sheet Transactions Balance Sheet Balance Sheet

Difference Between Trial Balance Balance Sheet The Following Points Will Help You To Understand The Difference Between Trial Balance Balance Sheet Balance

How To Record Balance Sheet Transactions Examples Getmoneyrich

Payable Turnover Ratio Meant To Be Details Meaning Interpretation

Balance Sheet Example Accountingcoach

How Balance Sheet Structure Content Reveal Financial Position

Purposethe Guide Is Created To Allow The Teacher Freedom In The Implementation Of The Material Into The C Student Activities Balance Sheet Agriculture Business

Example Cash Flow From Investing Activities Alphabet Inc Cash Flow Cash Flow Statement Investing

Cash Register Balance Sheet Google Search Money Template Numbers In Expanded Form Writing Practice

Daily Cash Flow Report Are You Managing The Daily Incoming And Outgoing Funds And Look For A Good Balance Sheet Template Report Template Cash Flow Statement

Balance Sheet Template 2 Balance Sheet Template Statement Template Balance Sheet

Pin On Business Studies As And Igcse

Purpose Of Balance Sheet Top 6 Uses Of Balance Sheet

Printable Balance Sheet Balance Sheet Template Budgeting Money Money Management

Accounting Book Closing Checklist Free Excel 03 Or Later Template Download From Microsoftoffic Accounting Books Excel Calendar Template Bookkeeping Business

A Cash Flow Statement Template Is A Financial Document That Provides Valuable Information About A Compan Cash Flow Statement Accounting Basics Accounting Notes